The Fed’s latest rate cut: what it really means for housing

Realtor.com/Getty Images

Realtor.com/Getty Images

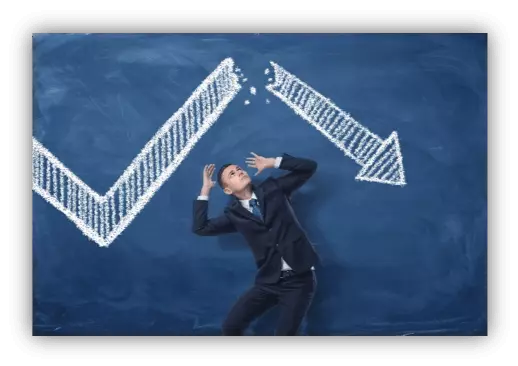

📉 The Federal Reserve cut its benchmark interest rate by 25 basis points—bringing it to a range of 3.75%–4.00%—in an effort to ease pressure on the job market. However, Chair Jerome Powell described this as likely one of the final cuts for 2025, noting that missing economic data (due to the government shutdown) and internal disagreement among Fed officials make a December cut uncertain. – Reuters

🧭 Powell also cautioned that Fed governors hold “strongly differing” views on how to proceed amid rising inflation risks and a softening labor market. – Fortune

🏠 Many still believe a Fed rate cut automatically lowers mortgage rates—but that’s a common misconception. Despite the Fed’s easing, the average 30-year fixed mortgage rate climbed to about 6.27%, as Powell’s cautious tone clashed with market expectations, prompting a rapid repricing of mortgage rates. – Mortgage News Daily

🔍 Bottom line for real estate professionals: Fed cuts don’t always mean lower mortgage rates. For now, homebuyers face elevated borrowing costs even as central bank policy shifts. Mortgage rates are more closely tied to Treasury yields and the economy. Still, homebuyers could benefit if the expectation of future cuts mounts and puts downward pressure on mortgage rates. CNBC

#RealEstateInsights #HousingMarket #MortgageRates #FedRateCut #HomeBuyingTips #MarketUpdate #BernadetteRealEstate #InterestRates #RealEstateAdvisor #EconomicUpdate

Categories

Recent Posts